ETH Price Prediction: Navigating Volatility Toward $15,000 Long-Term Target

#ETH

- Technical indicators show ETH consolidating below the 20-day MA with MACD signaling bullish momentum

- Mixed fundamental signals with ETF outflows countered by whale accumulation and institutional adoption

- Long-term $15,000 price target remains viable despite short-term volatility around $4,000 support

ETH Price Prediction

ETH Technical Analysis: Mixed Signals at $4,037

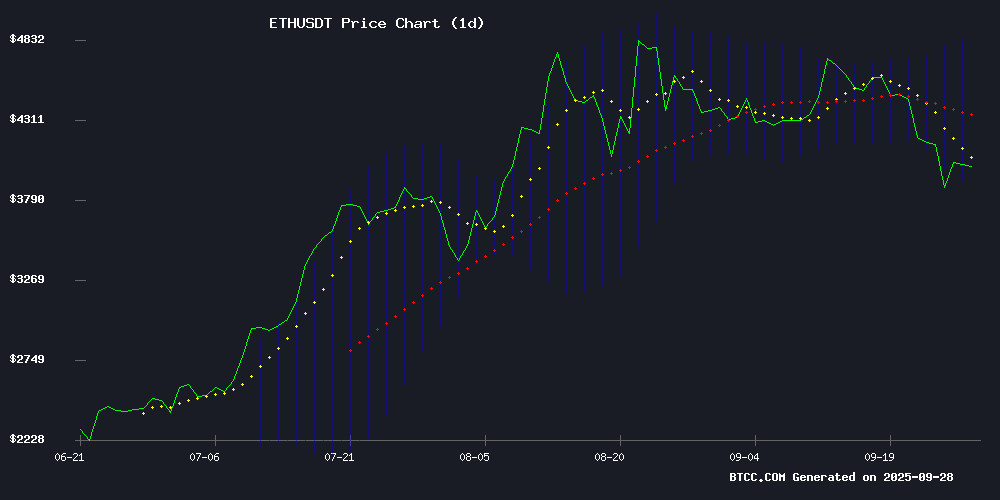

According to BTCC financial analyst Ava, Ethereum's current price of $4,037 sits below the 20-day moving average of $4,358, indicating potential short-term bearish pressure. However, the MACD reading of 194.79 shows bullish momentum remains intact. The Bollinger Bands position ETH NEAR the middle band, suggesting consolidation around current levels with support at $3,880 and resistance at $4,837.

Market Sentiment: Bullish Fundamentals Face Short-Term Headwinds

BTCC financial analyst Ava notes that while ethereum faces $800M in ETF outflows and fee stagnation concerns, several bullish factors persist. Whales have accumulated $1.6B in ETH over two days, and the launch of the first US staking ETF by REX-Osprey provides structural support. SWIFT's partnership with Linea for blockchain messaging represents significant institutional adoption that could drive long-term price appreciation.

Factors Influencing ETH's Price

Ethereum's Fee Stagnation Challenges Bullish $60K Price Forecast

Ethereum's market narrative faces divergence as Fundstrat's Tom Lee maintains a $60K price target while Mechanism Capital's Andrew Kang counters with skepticism. Kang argues that stagnant network fees—unchanged since 2020 despite 1000x growth in tokenized markets—undermine Lee's valuation thesis. "Value accrual doesn't scale linearly," Kang remarked, highlighting the disconnect between adoption metrics and on-chain revenue.

The debate centers on Ethereum's utility as a fee market. Flat transaction costs suggest muted demand for block space, contrasting with bullish expectations of exploding stablecoin and tokenization use cases. Lee's projection hinges on unfulfilled network activity growth that would theoretically drive fee revenue—and by extension, ETH's price.

Ethereum Faces $800M ETF Outflows as Whales Accumulate Amid Price Volatility

Ethereum's price hovered near $4,000 this week, caught in a tug-of-war between institutional outflows and whale accumulation. Spot Ethereum ETFs bled $800 million in outflows, while exchange balances plummeted to 2016 lows—a sign of tightening supply.

Analysts warn of liquidation risks below $3,700, where leveraged positions cluster. "The zone between $3,700-$3,800 is a powder keg," noted market observer TedPillows, pointing to derivative data showing dense long liquidation triggers. Yet blockchain data reveals large investors treating the dip as a buying opportunity.

The launch of a staking ETF further drained exchange liquidity, creating a supply crunch that could amplify future price moves. At press time, ETH traded at $4,000, down 10% weekly but finding support above $3,980.

REX-Osprey Launches First Ethereum Staking ETF in the US

REX-Osprey has debuted the United States' first Ethereum staking ETF, trading under the ticker ESK. The fund offers investors regulated exposure to ETH while enabling them to earn staking rewards. Structured under the 1940 Act, ESK combines directly staked Ethereum with staking-focused exchange-traded products, ensuring investors receive all rewards without fee retention.

"With ESK, we're giving investors access to Ethereum plus staking rewards in the most broad-based US ETF format," said Greg King, CEO of REX Financial. The fund distributes staking rewards monthly, bridging the gap between direct crypto participation and traditional investment vehicles.

This launch marks REX-Osprey's expansion into crypto ETFs, reflecting growing institutional demand for regulated digital asset products. The transparent, fee-free reward structure could attract both retail and institutional participants seeking Ethereum exposure.

Ethereum ETFs See Five Straight Days of Outflows as ETH Loses Momentum

Ethereum's market momentum falters as spot ETFs record $796 million in net outflows over five consecutive days, including a single-day withdrawal of $248.4 million on September 27. The cryptocurrency has dropped 10.25% this week, breaching key technical support levels.

BitBull analysts describe the sell-off as 'massive capitulation,' with ETH's price sliding toward $3,626 after losing its $3,875 support. Despite the downturn, staking activity and long-term holder accumulation suggest underlying strength in Ethereum's fundamentals.

ETH Price Tests $4,000 Support as Technical Indicators Flash Mixed Signals

Ether hovered near the $4,000 psychological level amid conflicting technical signals, with bearish momentum indicators contrasting against a resilient long-term uptrend. The second-largest cryptocurrency by market capitalization traded at $4,009.01, down 0.31% over 24 hours, as traders digested the absence of fresh catalysts.

Market technicians noted Ethereum's RSI at 37.81 approached oversold territory while the MACD histogram registered -62.16, reflecting short-term selling pressure. The asset maintained crucial support above $3,815, with the 200-day moving average of $2,951.33 underscoring the broader bullish structure.

Price action remained range-bound between $3,972.98 and $4,039.01, suggesting market indecision following recent gains. The consolidation appears driven by profit-taking rather than fundamental deterioration, with Ethereum's ecosystem activity continuing to attract institutional interest.

Ethereum Co-Founder Moves $6M ETH as Whales Accumulate $1.6B in Two Days

Jeffrey Wilcke, co-founder of Ethereum, transferred 1,500 ETH (approximately $6 million) to Kraken, marking another instance of his periodic exchange deposits. While retail investors may interpret this as a potential sell signal, the broader market tells a different story. Ether whales have aggressively bought 406,000 ETH worth $1.6 billion over the past 48 hours, signaling strong institutional accumulation.

Wilcke's transaction history shows a pattern of moving ETH to exchanges without immediate liquidation—previous deposits include $9.22 million in August and $262 million earlier. Analysts suggest these moves likely reflect portfolio management rather than bearish sentiment. Meanwhile, Ethereum's price held steady near $3,940 amid the whale activity.

Vitalik Buterin Warns EU’s Chat Control Could Break Digital Privacy: “Fight It”

Ethereum co-founder Vitalik Buterin has sharply criticized the European Union's proposed "Chat Control" legislation, arguing it undermines fundamental privacy rights in digital communications. The regulation, formally known as the Child Sexual Abuse Regulation (CSAR), would mandate sweeping surveillance of private messages across encrypted platforms like WhatsApp and Signal.

Critics view the proposal as a Trojan horse for mass surveillance, potentially affecting 450 million Europeans and setting a global precedent. Buterin's stance echoes broader concerns in the crypto community about government overreach into private digital spaces.

Mechanism Capital Challenges Tom Lee's Bullish Ethereum Thesis

Ethereum's long-term viability faces renewed scrutiny as Mechanism Capital co-founder Andrew Kang publicly dismantles Fundstrat's Tom Lee's optimistic outlook. The critique, delivered via social media platform X, targets five pillars of Lee's investment thesis, questioning Ethereum's fee model, competitive positioning, and institutional adoption narrative.

Kang's analysis disputes the notion that stablecoin and real-world asset adoption will automatically translate to higher network fees. On-chain data suggests these use cases haven't materially impacted Ethereum's revenue streams despite growing transaction volumes. The rebuttal also challenges Lee's "digital oil" analogy, arguing it fails to account for competing blockchains capturing market share in decentralized finance and tokenization.

Institutional enthusiasm for staking ETH comes under particular fire. Kang contends that yield-seeking behavior doesn't equate to long-term conviction, pointing to stagnant validator growth rates. The comparison of Ethereum to financial infrastructure giants appears particularly tenuous when examining actual settlement volumes and enterprise adoption patterns.

Ethereum Price Steady Above $4,000 With Bold $15,000 Forecast in Sight

Ethereum maintains its position above the critical $4,000 threshold, defying short-term market fluctuations. Tom Lee's audacious prediction of a $15,000 valuation by year-end has injected optimism among institutional investors, though technical analysts caution about current price consolidation.

The second-largest cryptocurrency by market cap recorded $56.91 billion in 24-hour trading volume, with its price hovering near $4,992 at press time. This represents a 1.31% gain amidst broader market uncertainty.

Crypto Rover highlights Lee's forecast as potentially transformative for ETH's market position relative to Bitcoin. The coming weeks may determine whether Ethereum breaks from its current 'chop zone' to validate bullish projections or faces temporary retracement.

Why Ethereum is Going Up? Everything You Need to Know

Ethereum's price surged back above $4,000, recovering from a week of volatility fueled by institutional inflows and whale activity. Technical indicators suggest the rally may have room to run as oversold conditions ease.

Vanguard's plans to launch crypto ETFs mirror BlackRock's aggressive Ethereum accumulation, with $254 million flowing into ETH products in a single day. These institutional moves are disproportionately impactful given Ethereum's $485 billion market cap—just one-fifth Bitcoin's size.

Whales deployed over $2 billion during the dip near $3,900, demonstrating conviction at key support levels. The staking ecosystem continues absorbing supply, creating structural scarcity as ETF demand grows.

SWIFT Partners with Linea to Pilot Blockchain Messaging and Interbank Token Settlement

SWIFT, the global financial messaging network, is collaborating with Linea, an Ethereum Layer-2 solution developed by Consensys, to test blockchain-based cross-border settlements. The pilot involves over a dozen major banks, including BNP Paribas and BNY Mellon, aiming to streamline payment instructions and settlement into a single on-chain transaction. This initiative seeks to reduce costs and enhance real-time transaction tracking.

The move comes as stablecoins surpass $270 billion in market value, signaling growing institutional adoption. SWIFT's exploration of blockchain technology could intensify competition for Ripple, which has long focused on cross-border payments. Linea's infrastructure is expected to provide secure, scalable solutions for SWIFT's 11,000+ member institutions.

How High Will ETH Price Go?

Based on current technical and fundamental analysis, BTCC financial analyst Ava projects Ethereum could reach $15,000 in the long term, though short-term volatility may persist. Key technical levels to watch include:

| Indicator | Current Level | Significance |

|---|---|---|

| Current Price | $4,037 | Testing $4,000 support |

| 20-day MA | $4,358 | Resistance level |

| Bollinger Upper | $4,837 | Near-term resistance |

| Bollinger Lower | $3,880 | Key support level |

| MACD | 194.79 | Bullish momentum indicator |

The convergence of whale accumulation, institutional adoption through SWIFT partnerships, and the launch of staking ETFs creates a strong foundation for price appreciation despite current ETF outflow pressures.